Data-Driven Decision Making in Law Firms: Strategies for 2026

A leadership meeting is underway.

Billing has closed. Financials are on the agenda. Someone asks a question that should already have an answer.

“Which matters are hurting our margins this quarter?”

A report is pulled. Then another. The numbers are close, but not identical. Someone explains the difference. Someone else questions the assumptions. The discussion shifts away from action and toward validation.

By the time the meeting ends, no decision has been made.

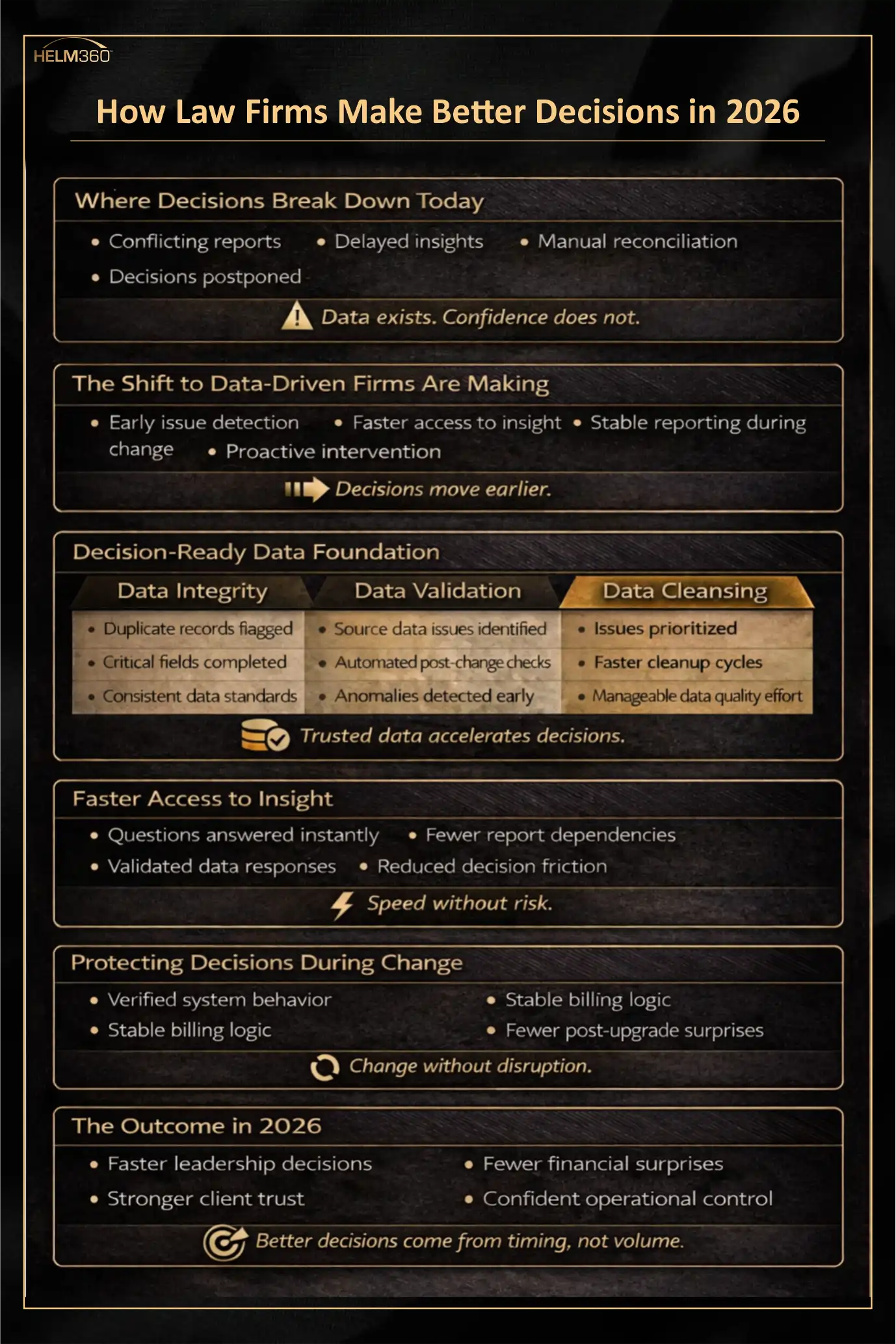

This is how decision-making quietly breaks down in many law firms. Not because the data is missing, but because it arrives too late, feels incomplete, or cannot be trusted with confidence.

As firms move toward 2026, this pattern is becoming harder to sustain. Clients expect clearer answers. Partners expect faster insights. Operations teams are managing more systems, more complexity, and tighter margins than ever before.

Data-driven decision-making is not about adding more reports. It is about changing how decisions are supported, when they are made, and what leaders can rely on in the moment.

What Data-Driven Decision Making Actually Means for Law Firms

In a law firm, data-driven decision-making shows up in practical, day-to-day ways.

It shows up when:

- A partner can see margin risk while a matter is still active

- A practice leader understands workload pressure before burnout occurs

- Finance can flag realization issues before invoices go out

- Leadership trusts the numbers enough to act without delay

This does not require perfect data or advanced analytics everywhere. It requires a small number of disciplines applied consistently.

The strategies below reflect what firms are already doing today to improve decision quality and what will become standard practice by 2026.

Strategy 1: Fix the Numbers Before Fixing the Decisions

In many law firms, the same question produces different answers depending on who is asked.

Finance reviews one report. Practice leadership reviews another. Operations brings a third version to the meeting. None of the numbers are wildly wrong, but none feel dependable enough to act on immediately.

This usually happens because small data issues accumulate quietly over time:

- Client and matter records created inconsistently

- Reporting-critical fields left incomplete

- Legacy fields reused for new purposes

- Assumptions embedded in reporting logic

These issues rarely feel urgent until leadership needs answers quickly.

At that point, meetings shift away from decisions and toward explanations. Confidence in the numbers weakens, and leaders begin to rely more on instinct than evidence.

Firms that break this cycle change one thing: they stop treating data cleansing as a one-time cleanup exercise.

Instead of waiting for audits or system upgrades to expose problems, they identify issues in source data early and consistently. Duplicate records are flagged before they spread. Missing or inconsistent attributes are detected before they affect reporting. Data cleansing becomes faster, more targeted, and easier to manage.

This is where automated data discovery fits naturally into daily operations.

Helm360 supports this approach through Digital Eye, its automated data discovery tool designed to quickly identify issues in source data and accelerate data cleansing. By surfacing data quality problems early, Digital Eye helps firms improve trust in their data without turning data cleanup into a heavy, manual effort.

Why This Matters in 2026

Firms that cannot trust their numbers in the moment will make slower decisions and miss early warning signs that others identify in time.

Strategy 2: Bring Answers Closer to the Moment Decisions Are Made

Once firms begin to trust their data, a new challenge often appears.

The numbers are accurate, but access to them is slow.

Answers sit in reports that must be requested. Follow-up questions require more analysis. Even simple clarifications turn into email threads or extra meetings. By the time the information is ready, the urgency has passed, or the decision window has narrowed.

This delay affects how leaders behave. They ask fewer questions because getting answers feels time-consuming. Over time, decisions slip back to habit and intuition, even when better information is available.

Firms preparing for 2026 are reducing this friction by changing how insights are delivered.

Instead of relying on static reports, they give leaders direct access to data. Common questions no longer require formal requests or technical help. Answers are available when the question is asked, not days later.

This is where conversational access becomes part of everyday decision-making.

Helm360’s Termi allows partners, finance leaders, and operations teams to ask questions in natural language and receive answers directly from firm data. This way, firms gain speed without sacrificing accuracy.

Why this matters in 2026

Decision speed will increasingly separate firms that intervene early from those that react after the fact.

Strategy 3: Keep Decisions Stable While Systems Keep Changing

As access to insight improves, another challenge becomes more visible.

Law firm systems are constantly changing. Cloud migrations, upgrades, integrations, configuration changes, and new workflows are now routine. Each change introduces the possibility that something small will break quietly.

A billing rule behaves differently. A workflow step fails. A report produces unexpected results.

Often, these issues surface only after invoices are issued or reports are questioned. By then, decisions based on that data are already in motion.

Firms that rely on data for decision-making protect themselves differently.

They do not assume systems behave the same way after a change. They verify it.

Testing becomes part of how firms protect decision integrity. Critical workflows are validated before and after changes. Billing and reporting outputs are confirmed. Confidence is preserved even as systems evolve.

Helm360 supports this approach through Quality Assurance and User Acceptance Testing.

Why this matters in 2026

System change is constant. Decision confidence will increasingly depend on what has been verified, not what is assumed.

Strategy 4: Identify Risk Before Results Are Final

When data is trusted, accessible, and stable, firms begin to notice something else.

They no longer have to wait for outcomes to be finalized before responding.

Instead of reviewing margin issues after billing, firms can see pressure building during active matters. Instead of explaining the realization drops at quarter-end, they can identify risk during billing cycles. Instead of reacting to staffing strain, they can spot capacity tightening earlier.

This changes the tone of leadership discussions.

Meetings move away from explaining what went wrong and toward deciding what needs attention now. Data becomes an early signal rather than a post-mortem record.

Helm360 regularly explores this shift through conversations with legal and technology leaders on The Legal Helm Podcast.

Why this matters in 2026

By the time results are final, options are limited. Firms that act earlier preserve margins, capacity, and client trust.

Moving Toward 2026 with Confidence

By 2026, data-driven decision-making will not be a differentiator. It will be an expectation.

Firms that succeed will rely on:

- Trusted data foundations

- Faster access to insight

- Verified system behavior

- Earlier intervention points

Helm360 works with law firms to support this shift across data services, AI-enabled insight, and testing strategies that protect decision quality.