Why Do So Many Lawyers Struggle to Charge What They Are Worth?

2024 is going to be challenging.

At least that seems to be the consensus amongst managing partners and firm’s management boards, and few would have cause to disagree.

LexisNexis have just published a blog in which they open with the comment… “We look at the legal trends set to define the year ahead, including the rise of generative AI, the acceptance of alternative

legal fees, exploration of new markets, and so much more. The legal sector is evolving at breakneck

speed…”

As pricing specialists, one of these trends caught our attention….

All of which gives rise to a follow-on question – ‘why do so many lawyers struggle to charge what

they are worth?’ Based on our work with over 300 law firms in 30 countries, there several very clear

explanations…

- Pricing is a skill, but is still thought of by most firms as a relatively rudimentary administrative function. The art and science of pricing is highly evolved in most sectors of the economy – professional services like law, considerably less so.

- When it comes to pricing strategy, tactics and negotiation, most lawyers have had no training at all. Consequently, most don’t even know what they don’t know.

- At the risk of giving offence (and I say this as a former law firm managing partner), financial literacy amongst law firm partners is, shall we say, mixed.

- Until now, there has been a complete absence of any pricing technology that is built specifically for the needs of lawyers, as opposed to the needs of the firm’s business services professionals who can use spreadsheets and data visualisation software like Power BI very effectively. They are not a typical lawyer’s tools of choice.

- Most lawyers hate talking about fees with their clients.

- The combined effect of 1) to 5) is a profound lack of pricing and commercial confidence amongst partners.

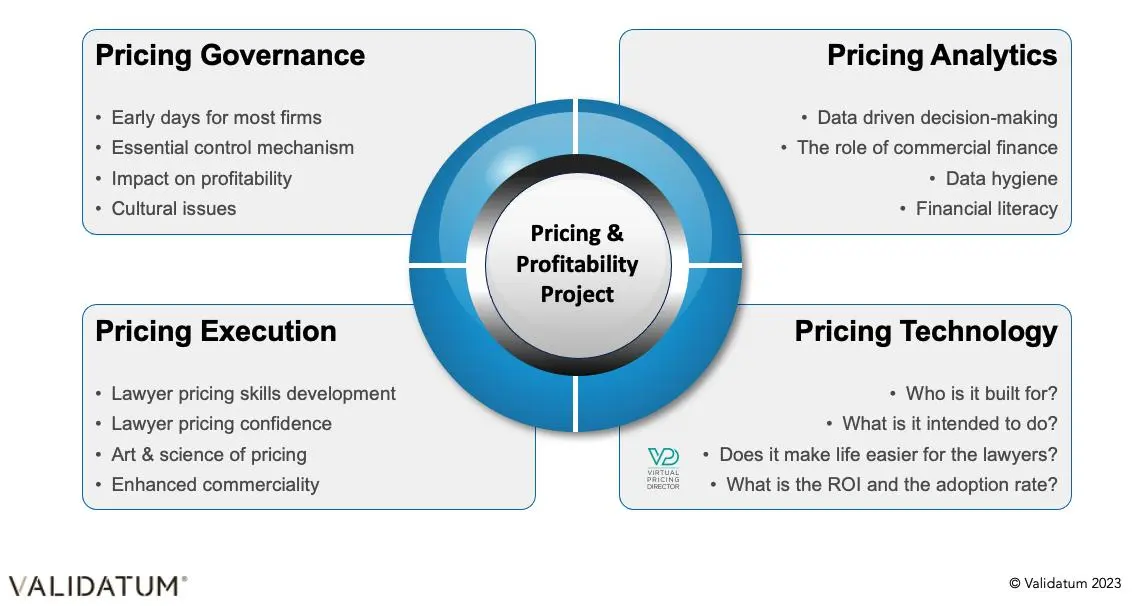

To address these challenges, there are broadly speaking four areas that a firm needs to tackle…

Here are some of the challenges we see…

Pricing governance and policy:

The firm needs to debate and reach a consensus on such things as…

- The lack of a shared and consistently implemented approach to pricing.

- Pricing policies that either don’t exist or aren’t well understood and universally enforced – for example do you prohibit colleagues in different disciplines from committing others to pricing arrangements on a project without discussing it with them first?

- Where do you set the dial in terms of partner pricing autonomy and discretion – a complete free for all, centralised micro-management or somewhere in between.

- Do you have strong pricing leadership in the firm, both at the top and at a practice area level?

- Do you have a preoccupation with turnover as opposed to profit? Which is more important to you and why?

- Do you have a price and market position disconnect – most firms do not understand that price is a powerful proxy for quality. Firms claim a certain market position vis quality of advice and service and then price below that, thereby undermining the message.

- Do you have a rigorous triaging and ROI assessment of RFPs?

- Do you have effective induction training on pricing?

- Do you have a surgical approach to increasing rates, or the more usual unsophisticated annual CPI adjustment rate review letter?

- Are your pricing, marketing and BD efforts synthesised?

Pricing Analytics & Reporting:

- Practice management software has historically provided plenty of data, but data on its own is largely useless unless it also provides actionable insights. What insights do you currently extract from ProLaw?

- Is your firms’ approach to pricing one that treats it as a science or a dark art – or maybe a bit of both?

- Fixed fee arrangements suffer from high write-offs and poor realisation rates due to lack of historical analysis.

- Any firm serious about utilising contingent or conditional fee agreements must invest in proper analytics capability, and not simply something cobbled together in an Excel spreadsheet.

- Misaligned reporting dashboards that incentivize sub-optimal pricing behaviour.

Pricing Skills, Resources & Pricing Execution:

- Do you see pricing as an administrative function or a legal practice and law firm management skill?

- A broad lack of price negotiation skills and a lack of awareness or understanding of the many pricing strategies and tactics available to lawyers, results in pricing that is often a poor ‘fit’ for the client and/or the firm.

- A lack of pricing collateral, templates, and pricing precedents

- Do you have a strategy and the skills to cope with the increasing involvement of procurement on the client side?

- Incomprehensible client engagement and pricing documentation is often focused on regulatory compliance and limitation of liability, but frequently falls at the hurdle when it comes to providing, clarity in relation to clients’ most basic questions; “what are you going to do for me, who is going to do it, when will it be done and how much will it cost?”

- Confidence is critical to good pricing behavior. Do you set and negotiate prices confidently or from a perspective of fear; fear of losing the client and/or fear of losing the job?

Pricing technology:

- Do most of your lawyers still pluck figures out of the air based on the last job?

- Do you have an Excel pricing tool that was built internally, can only be used, and understood by two people, and which most of your lawyers either don’t know exists or hate and won’t use.

- Are you aware that there is now readily available technology like Virtual Pricing Director® (which works with all the major PMSs including ProLaw and 3E) built for the needs of the average busy and stressed lawyer and which, when combined with ‘people and process’ improvements can have a profound impact on profitability and client relations?

Clearly, these issues can’t all be tackled overnight or simultaneously. Which issues are picked off and in which order very much depends on the status of pricing in a firm at any given point in time. There simply isn’t a one-size-fits-all answer to that question.

Before riding off in all directions at once therefore, it can often be helpful for firms to do a pricing ‘stock-take’ first. “Where are we currently with your pricing? What resources do we have? What are we good at in the pricing space and where are we doing poorly? What parts of the firm are doing well on pricing and which areas are struggling? Why?”

This kind of candid stock-take can help to provide a solid platform for further decisions about pricing. If you would like a free copy of our Pricing Maturity Diagnostic questionnaire, drop us a note.

Richard Burcher, Chairman, Validatum® and Virtual Pricing Director®

richard.burcher@validatum.com